Managing a network of 11,000 banks across 200 countries worldwide, SWIFT stands as a cornerstone of international banking. However, many people wonder if a SWIFT code is the same as a routing number when making transfers.

While both serve as essential banking identifiers, these codes fulfill different purposes. SWIFT codes, consisting of 8 or 11 alphanumeric characters, facilitate international money transfers. In contrast, routing numbers, made up of nine digits, handle domestic transactions within the United States banking system.

This guide explains the key differences between SWIFT codes and routing numbers, their specific uses, and how to avoid common transfer mistakes that could lead to failed transactions or misplaced deposits.

About SWIFT Codes vs Routing Numbers

Bank identification codes play a vital role in the global financial system. Since many wonder “is swift code same as routing number,” let’s examine these distinct banking identifiers in detail.

What is a SWIFT code?

SWIFT codes, additionally known as BIC (Business Identifier Code), serve as unique identifiers for banks and financial institutions worldwide. The Society for Worldwide Interbank Financial Telecommunication (SWIFT) issues these codes, enabling secure communication between financial institutions across borders.

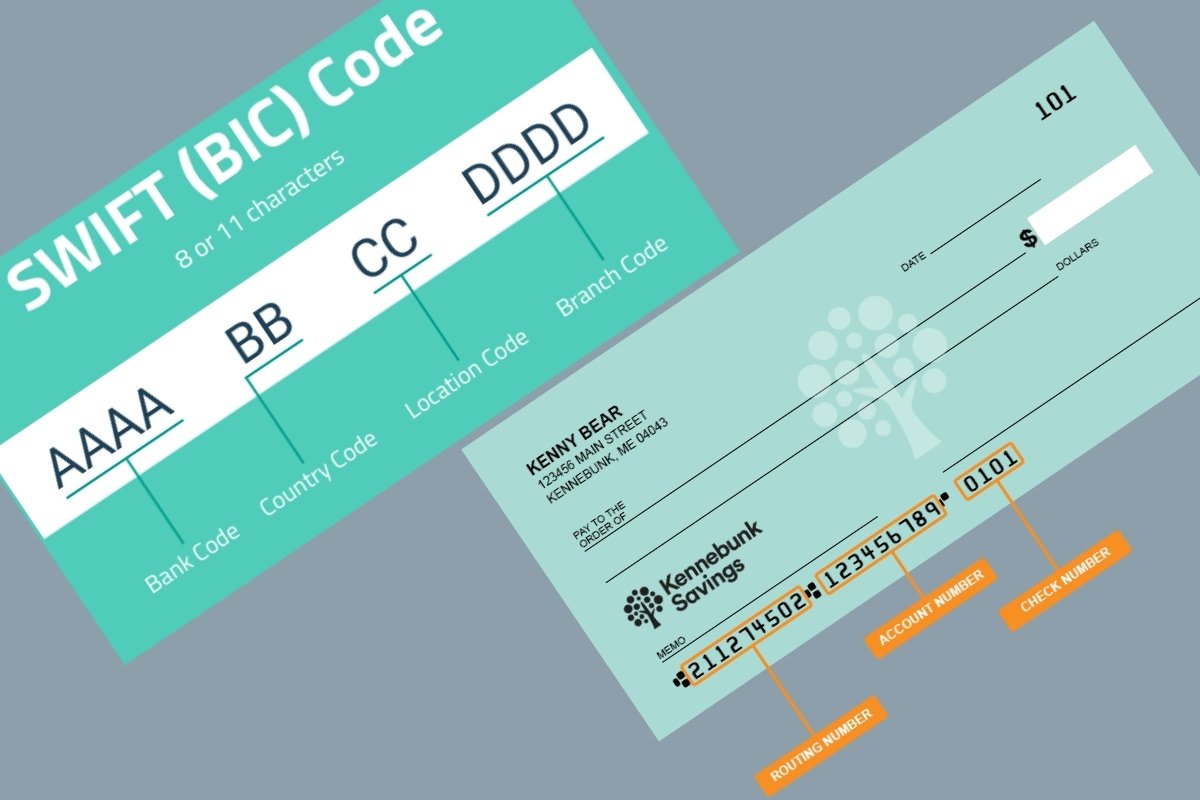

A SWIFT code consists of 8 to 11 alphanumeric characters structured in four specific components:

- First four letters represent the bank’s abbreviated name

- Next two letters indicate the country code

- Following two characters specify the head office location

- Optional last three characters identify specific branches

For instance, a bank might use ‘BSCH’ as its identifier, followed by ‘ES’ for Spain, ‘MM’ for Madrid, and ‘XXX’ to indicate centralized transaction settlement.

What is a routing number?

Routing numbers, established by the American Bankers Association in 1910, function as nine-digit identifiers specifically for U.S. financial institutions. These numbers are exclusively issued to federal or state-chartered financial institutions eligible for Federal Reserve Bank master accounts.

The nine-digit routing number comprises three distinct elements:

- First four digits: Federal Reserve routing code

- Next four digits: ABA institution code

- Final digit: Check digit for verification

Key differences at a glance

Understanding whether is swift code the same as routing number requires examining their fundamental differences:

Geographic Coverage

- SWIFT codes operate globally across more than 11,000 financial institutions

- Routing numbers function exclusively within the U.S. banking system

Structure and Format

- SWIFT codes use both letters and numbers, ranging from 8 to 11 characters

- Routing numbers consist of exactly nine numerical digits

Primary Functions

- SWIFT codes facilitate international wire transfers and cross-border payments

- Routing numbers handle domestic transactions including direct deposits, ACH transfers, and bill payments

Institutional Requirements

- SWIFT codes can be assigned to various financial institutions, including banks, clearinghouses, and brokerages

- Routing numbers are limited to Federal Reserve-eligible financial institutions

Transaction Processing

- SWIFT codes enable banks to share detailed transaction information, including account status and transfer details

- Routing numbers direct domestic payments through the Federal Reserve System

These distinctions clarifies why is the swift code the same as routing number is a common question among those new to international banking. Although both serve as bank identifiers, they operate in different spheres of the financial world. Furthermore, some large U.S. banks maintain multiple routing numbers based on location and transaction type, additionally they possess specific SWIFT codes for international operations.

When to Use SWIFT Codes

When to use SWIFT codes remains crucial for anyone sending money internationally. As a banking industry insider at swiftheadline.com, let’s explore the specific scenarios where SWIFT codes, rather than routing numbers, become essential for your transactions.

International wire transfers

SWIFT codes play a fundamental role in facilitating international wire transfers. Before initiating a transfer, banks require several key pieces of information to ensure the funds reach their intended destination:

- Recipient’s full legal name and current address

- Bank name and address receiving the transfer

- SWIFT/BIC code of the receiving bank

- Account number or IBAN of the recipient

- Purpose of sending funds

Through the SWIFT network, nearly 50% of payments reach beneficiaries within 30 minutes, moreover 40% complete in under 5 minutes, with almost all transactions finalizing within 24 hours. This efficiency stems from SWIFT’s vast network connecting more than 11,000 financial institutions across 200 countries and territories.

Presently, around half of all high-value cross-border payments worldwide utilize the SWIFT network. The system processes an average of 35 million orders daily, demonstrating why is swift code same as routing number remains a common query among those new to international banking.

Cross-border payments

For cross-border transactions, is a swift code the same as a routing number becomes particularly relevant as SWIFT codes serve distinct functions from routing numbers. The SWIFT system operates through a sophisticated network where:

- Banks communicate securely about financial transactions

- Payment instructions travel between institutions

- Funds settle through correspondent banking relationships

In situations where banks lack direct relationships, intermediary banks facilitate the transfer. This process occurs when:

- The sending bank initiates the transfer

- An intermediary bank (correspondent) processes the transaction

- The receiving bank credits the final beneficiary

According to recent data, 84% of all payments on the network complete directly or with just one intermediary, making the process more efficient than commonly perceived. The Consumer Financial Protection Bureau (CFPB) oversees international transfers exceeding $15, ensuring consumer protection throughout the process.

For transfers over $10,000, banks must report the transaction to the IRS. Moreover, individuals holding foreign financial assets worth $50,000 or more must report them using Form 8938 with their annual tax returns. Therefore, understanding whether is routing number same as swift code becomes essential for compliance purposes.

SWIFT has modernized its services through initiatives like SWIFT GPI (Global Payments Innovation), which enables real-time tracking and enhanced transparency. This service processes over $300 billion in daily transactions, offering features such as:

- End-to-end payment tracking

- Fee visibility

- Payment certainty

- Improved supplier relationships

- Faster invoice reconciliation

The system maintains a remarkable 99.999% network availability, ensuring reliable service for international transactions. Consequently, is swift code and routing number the same becomes less relevant as each serves its unique purpose in different banking scenarios.

When to Use Routing Numbers

Routing numbers serve as the digital address system for U.S. financial institutions, directing domestic transactions to their intended destinations. As many ask “is swift code same as routing number,” understanding when to use routing numbers becomes essential for seamless banking operations.

Domestic bank transfers

Unlike SWIFT codes, routing numbers exclusively handle transactions within the United States banking system. These nine-digit codes identify specific financial institutions responsible for payment processing and money transfers between accounts. Through routing numbers, banks can:

- Process electronic funds transfers between different personal and business accounts

- Facilitate transfers between accounts at different banks

- Enable secure transaction processing through the Federal Reserve System

Direct deposits

Direct deposits represent one of the most common applications of routing numbers in modern banking. These electronic transfers require both the bank’s routing number and the recipient’s account number. Direct deposits serve multiple purposes:

- Payroll processing from employers to employees

- Government benefit payments, including Social Security and tax refunds

- Veterans Administration (VA) benefits distribution

- Regular investment or retirement account contributions

Setting up direct deposit requires providing the correct routing number to ensure funds reach their intended destination. Notably, routing numbers are determined by where the deposit account was opened, not the account holder’s current location.

Bill payments

The evolution of routing numbers from paper check processing to digital transactions has transformed bill payment systems. Today, these numbers enable various payment methods:

- Automatic monthly bill payments

- Electronic funds transfers for utilities

- Tax payments to federal and state authorities

- Scheduled loan payments

- Connection to payment applications and financial software

For businesses accepting payments, routing numbers facilitate:

- Receipt of customer payments

- Processing of electronic contributions

- Settlement of service payments

- Integration with accounting systems

The distinction between “is routing number same as swift code” becomes crucial as routing numbers handle these domestic transactions exclusively. The American Bankers Association (ABA) issues routing numbers solely to federal or state-chartered financial institutions eligible for Federal Reserve Bank master accounts.

Notably, inaccurate or incomplete routing number information can result in substantial financial losses, potentially costing organizations thousands of dollars monthly. Therefore, verification remains essential when:

- Setting up new payment relationships

- Connecting financial accounts to payment services

- Establishing automatic payment systems

- Processing electronic transfers

Through the Federal Reserve’s payment systems, routing numbers enable direct access to central banking functions and facilitate settlements between participating institutions. This systematic approach ensures that domestic financial transactions proceed efficiently and securely within the U.S. banking network.

Finding Your Bank Codes

Locating bank codes efficiently ensures smooth financial transactions, especially when asking “is swift code same as routing number.” Let’s explore the reliable methods to find these essential banking identifiers.

Locating SWIFT codes

Several methods exist to find your bank’s SWIFT code, making it easier to answer “is swift code the same as routing number.” Here are the most reliable approaches:

Bank Statements: Most financial institutions print SWIFT codes directly on monthly statements. This placement ensures easy access when setting up international transfers.

Online Banking: After logging into your account, SWIFT codes typically appear under:

- Account information section

- International transfer setup pages

- Payment settings menu

Official Bank Website: Banks commonly list their SWIFT codes in:

- FAQ sections

- International payments pages

- Account services area

For verification purposes, SWIFT codes follow a standardized format:

- 8-11 characters in length

- First 4 characters represent the bank

- Next 2 characters indicate the country

- Following 2 characters show the city

- Optional last 3 characters identify specific branches

Finding routing numbers

As many wonder “is routing number same as swift code,” finding routing numbers involves different methods. The American Bankers Association (ABA) maintains strict control over these identifiers.

Paper Checks: The most straightforward method reveals routing numbers:

- Located at bottom left corner

- Always 9 digits in length

- Surrounded by special symbols (not part of the number)

Digital Banking Solutions:

- Mobile Banking Apps:

- Select desired account

- Navigate to account management

- Look for “Account & routing number” section

- Online Banking Platforms:

- Log into account dashboard

- Choose account details

- Find routing information in summary section

Monthly Statements: Routing numbers appear in the upper right corner of bank statements, answering “is swift code and routing number the same” by showing their distinct formats.

Important considerations when using these codes:

- Banks may have multiple routing numbers based on region

- Some institutions use different numbers for various transaction types

- Verification remains crucial as incorrect codes can cause costly delays

- The ABA routing number lookup service limits users to:

- Two lookups per day

- Ten lookups monthly

For enhanced security, financial institutions recommend verifying codes through official channels before initiating transactions. This practice helps avoid transfer delays and ensures “is the swift code the same as routing number” concerns don’t lead to transaction errors.

Common Transfer Mistakes to Avoid

Sending money across financial networks requires meticulous attention to detail, as even minor errors can lead to significant complications. Understanding why is swift code same as routing number matters helps avoid costly transfer mistakes.

Using wrong codes

Typing errors remain among the most frequent causes of failed transfers. Even a single incorrect digit in routing numbers or SWIFT codes can:

- Send funds to unintended recipients

- Trigger transaction rejections

- Cause processing delays

For international transfers asking “is swift code the same as routing number,” incorrect SWIFT codes typically result in:

- Transaction rejection and return of funds

- Additional processing fees

- Potential deposit into wrong accounts

When wondering “is a swift code the same as a routing number,” remember that format errors also cause problems. Common formatting mistakes include:

- Adding spaces between SWIFT code characters

- Mistyping bank country codes

- Using incorrect branch identifiers

Missing information

Beyond asking “is routing number same as swift code,” ensuring complete transfer details prevents delays. Essential information includes:

- Full legal name matching bank records

- Complete account numbers

- Required reference numbers

- Purpose codes for international transfers

The FBI reports over 521,652 instances of cybercrime in 2023, emphasizing why proper verification matters. Missing or incorrect details can result in:

- Transfer delays lasting 3-14 business days

- Investigation periods up to 90 days

- Potential loss of funds

Verification steps

To address “is swift code and routing number the same” concerns while ensuring transfer success, follow these verification procedures:

Before Transfer:

- Double-check recipient details against official documents

- Verify bank codes through authorized sources

- Confirm transaction limits and requirements

During Setup:

- Use secure communication channels

- Avoid public domain email addresses

- Implement two-step verification processes

After Submission:

- Monitor transaction status

- Keep transfer documentation

- Contact banks promptly if issues arise

For those asking “is the swift code the same as routing number,” banks typically follow specific resolution steps when errors occur:

- Transaction flagging for review

- Communication with involved parties

- Document verification requests

- Fund recovery procedures

Banks generally have 10 business days to investigate unauthorized transactions, extending to 20 days for new accounts. Moreover, temporary credits may be issued during investigations, minus a maximum of USD 50.00.

These distinctions and following proper verification procedures ensures smoother transactions across both domestic and international banking networks. Through careful attention to detail and proper verification steps, many common transfer mistakes become preventable.

Is Swift Code Same as Routing Number Frequently Asked Questions

Is a SWIFT code the same as a routing number?

No, a SWIFT code and a routing number are not the same. A SWIFT code is used for international wire transfers, while a routing number is used for domestic transactions within a country, primarily in the U.S.

What’s the main difference between SWIFT codes and routing numbers?

SWIFT codes are used for international transfers across a global network of banks, while routing numbers are specific to domestic transactions within the U.S. banking system. SWIFT codes are alphanumeric and 8-11 characters long, whereas routing numbers are always 9 digits.

Can I use a routing number for an international wire transfer?

No, you cannot use a routing number for international wire transfers. For international transactions, you need to use a SWIFT code. Routing numbers are only used for domestic transfers within the United States.

How can I find my bank’s SWIFT code?

You can find your bank’s SWIFT code on your monthly bank statements, by logging into your online banking platform, or by checking your bank’s official website. If you’re still unsure, it’s best to contact your bank directly for the correct SWIFT code.

Are SWIFT codes necessary for all international money transfers?

Yes, SWIFT codes are generally required for international money transfers. They ensure that your funds are directed to the correct bank and account internationally. Without a SWIFT code, international transfers may not be possible or could be significantly delayed.

What information do I need to provide for an international wire transfer?

For an international wire transfer, you typically need to provide the recipient’s full name and address, their bank’s name and address, the recipient’s account number or IBAN, and the bank’s SWIFT code. It’s also important to specify the purpose of the transfer and ensure all details are accurate to avoid delays or errors.

Do all banks have both a SWIFT code and a routing number?

No, not all banks have both. U.S. banks usually have both a routing number (for domestic transactions) and a SWIFT code (for international transfers). However, banks in other countries may only have a SWIFT code.

Can a bank have multiple SWIFT codes or routing numbers?

Yes, banks may have multiple routing numbers for different regions or transaction types. Similarly, large banks may have different SWIFT codes for various branches or international operations.